What Is the Ansoff Matrix?

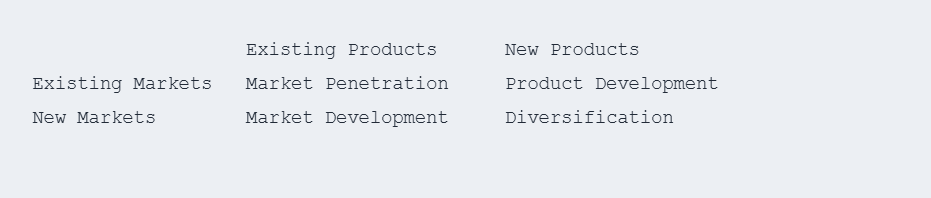

The Ansoff Matrix is a strategic planning tool that helps businesses identify the best growth direction by evaluating whether to focus on:

1. Existing products vs New products

2. Existing markets vs New markets

It creates four clear growth strategies:

Market Penetration, Market Development, Product Development, Diversification

Why the Ansoff Matrix Matters

- Helps leaders choose the safest vs boldest growth moves

- Clarifies which opportunities align with capability & risk appetite

- Avoids random, unstructured expansion

- Useful for product strategy, GTM, and corporate growth planning

- Common in consulting, MBA prep, and case interviews

It’s one of the simplest and most intuitive growth frameworks.

The Ansoff Matrix (Core Structure)

1. Market Penetration (Existing Product × Existing Market)

Safest growth strategy.

How to grow:

- Increase usage frequency

- Reduce churn

- Improve customer experience

- Gain share from competitors

- Launch targeted promotions

- Strengthen distribution

- Improve product quality

When to use:

- Market has room to grow

- Competition is weak or fragmented

- Company is already strong in the segment

2. Product Development (New Product × Existing Market)

Introduce new products to current customers.

How to grow:

- Add new variants

- Introduce premium or budget versions

- Launch complementary products

- Bundle services

- Add features or upgrades

When to use:

- Customer needs are evolving

- Strong brand loyalty

- Market saturated for existing products

3. Market Development (Existing Product × New Market)

Take current products into new geographies or segments.

How to grow:

- Expand to new cities or countries

- Target new customer groups

- Enter new distribution channels

- Adapt product for local preferences

When to use:

- Product is successful in existing market

- Similar customer behavior exists elsewhere

- Company has excess capacity

4. Diversification (New Product × New Market)

Highest risk, highest reward.

Types of diversification:

- Related diversification: enters adjacent category

- Unrelated diversification: enters completely new industries

How to grow:

- Build or acquire new capabilities

- Create entirely new product lines

- Acquire companies in new sectors

When to use:

- Market saturated

- Strong cash reserves

- Strategic long-term vision

- Need to reduce dependence on one business

How to Apply the Ansoff Matrix (Step-by-Step)

1. Assess current product-market position

Know where your strongest foothold is.

2. Identify growth goals

Revenue growth? Diversification? Market share?

3. Evaluate each Ansoff quadrant based on feasibility

Use data + capability assessment.

4. Choose the best-fit quadrant(s)

Most companies use a mix:

- 1 short-term bet (low risk)

- 1 long-term bet (higher risk)

5. Build an execution plan

- Investment

- Timeline

- Capability gaps

- Dependencies

- Partnerships

Mini Example: Ansoff Matrix Case

Company: A healthy snack brand selling granola bars

Objective: Grow revenue 30% next year

Market Penetration:

- Increase shelf space in supermarkets

- Boost ad spend

→ Expected growth: +8%

Product Development:

- Launch high-protein bars

→ Expected growth: +12%

Market Development:

- Expand to Tier-2 cities

→ Expected growth: +7%

Diversification:

- Launch healthy ready-to-drink smoothies

→ High risk, long-term option

Recommendation:

Focus on product development + market penetration for near-term growth.

Explore diversification via pilot testing.

Common Mistakes to Avoid

- Over-focusing on diversification (too risky)

- Ignoring capability constraints

- Launching new products without customer research

- Entering new markets without localization

- Trying to do all four strategies at once

Ansoff helps prioritize — not expand blindly.

Where the Ansoff Matrix Is Used

- Growth strategy

- Product strategy

- Market expansion

- Startup scaling

- Corporate planning

- Case interviews

It’s a simple but powerful roadmap for structured growth decisions.